As a consultant, I can help you to access government R&D programs because both the federal Scientific Research & Experimental Development (SR&ED) tax incentive and NRC‑IRAP grants hinge on well‑written technical documentation.

SR&ED is the federal government’s flagship R&D tax credit

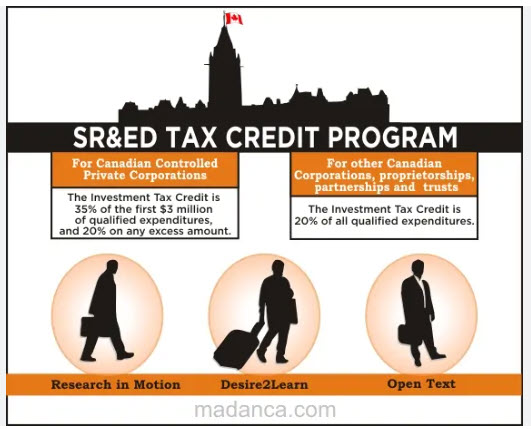

- Most companies get a base 15 % investment tax credit on eligible R&D expenses.

- Canadian‑controlled private corporations (CCPCs) receive an enhanced 35 % credit on their first C$4.5 million of annual SR&ED spending and

- Ontario offers an 8 % refundable credit (OITC) plus a 3.5 % non‑refundable research and development credit (ORDTC).

- Eligible costs include wages for R&D staff, materials and prototype components, contractor fees and even a portion of overhead.

- Claims must be filed within 18 months of the fiscal year end, and they require a technical narrative that clearly explains the technological objectives, uncertainties and experimental work.

- All calculations for the tax credits are calculated and controlled by your accountant.

IRAP

- IRAP, on the other hand, provides non‑repayable contributions and advisory support to help small and medium‑sized businesses (< 500 employees) develop and commercialize technology‑driven innovations.

- The program can fund projects at various stages of the innovation cycle and, since 2018–19, has the authority to fund larger projects up to C$10 million. Applicants work with an industrial technology adviser (ITA) who assesses the business and, if eligible, invites it to submit a project proposal.

How Do I Play a Role in Your Success?

SR&ED and IRAP reviewers are not experts in your business, so success hinges on how clearly you explain a project’s technological challenges and innovations. SR&ED guidance stresses that companies must describe why they undertook R&D, the scientific or technological uncertainties they faced, and the systematic investigation used to overcome those uncertainties.

Poorly documented claims often fail. SR&ED consultants note that strong technical writing translates complex R&D work into clear, concise and accurate narratives that CRA reviewers can understand.

Documentation should include project summaries, detailed technical reports and lab/experiment logs, all of which are squarely within a technical writer’s skillset.

This is the value I bring to you.

How Do You Decide?

- I can help your firm to unlock refundable tax credits and non‑repayable funding.

- CCPCs can recover up to 35 % of their first C$4.5 million in R&D spending and that Ontario adds an 8 % refundable credit, improving cash flow.

- For example, in the welding industry, innovations in welding processes, custom jigs, prototype development or novel materials often qualify for SR&ED. We can discuss how improvements to welding processes, prototype fabrication and process automation can meet SR&ED’s definition of technological advancement and uncertainty.

- Similarly other industries that are on the verge of innovation, would also qualify for SR&ED.

- Once you appoint me as your representative to delve into the government programs, I can share with you examples and case studies to demystify the program and how I can add value.

- Depending on the information you share with me, we can discuss IRAP’s eligibility criteria (incorporated Canadian SME, fewer than 500 employees, technology‑driven commercialization plans and the fact that there is a system where applicants are guided through the proposal process).

- I provide a free discovery consultation. During this time, I will review your company’s recent projects to assess whether they involve technological uncertainty and therefore could qualify for SR&ED. This helps you to see the value before committing. Please remember I will work with SR&ED consultants and accountants for financial calculations while I craft the technical narrative and documentation.

- I will collaborate with SR&ED consultants, accountants and incubators. Many fabricators already work with accountants who handle tax returns.

- Because CRA and IRAP reviewers may audit claims, my meticulous documentation—project summaries, technical reports and lab notes — reduces the risk of disallowed claims and ensures companies can substantiate their projects during audits. Remember, my writing follows CRA’s guidance on articulating technological objectives and uncertainties.

Conclusion

By offering my unique collaborative services I help firms navigate SR&ED and IRAP as a sound strategy. Both programs provide substantial financial benefits—federal credits of 15–35 % plus Ontario’s 8 % refundable credit and IRAP contributions that support technology‑driven projects — but they hinge on clear, well‑documented technical narratives.

You are free to do your own due diligence and discuss with your partners, financial advisers, accountants, engineers, etc. You will realize how valuable it is to take me up on my offer to collaborate with you to change your business paradigm where you can offer solutions in this new era of Artificial Intelligence (AI) uncontrolled wildfires, rising insurance rates, economic uncertainties, etc.

I will show you with specific real examples how you can make a difference!

Finally, remember, consultation is FREE, and you are under no obligation to use our services. You are free to send an email to Info@Right2Write.ca or complete the Comments section below.

Leave a comment